In this three-part blog series, we’ll explore the performance impact and key benefits of Decision Intelligence as well as the most common use cases in the industry. Decison Intelligence platforms automate complex decisions using machine learning, process automation, and a business rules engine. We’ll begin in this article with an overview of the impact of Decision Intelligence on overall business performance, followed by highlights from common use cases, and the five key benefits of Decision Intelligence.

- What to dig deeper? Read our ebook: Innovating Financial Services with Decision Intelligence

How Decision Intelligence Fuels Financial Services Performance

The Shifting Environment of Financial Services

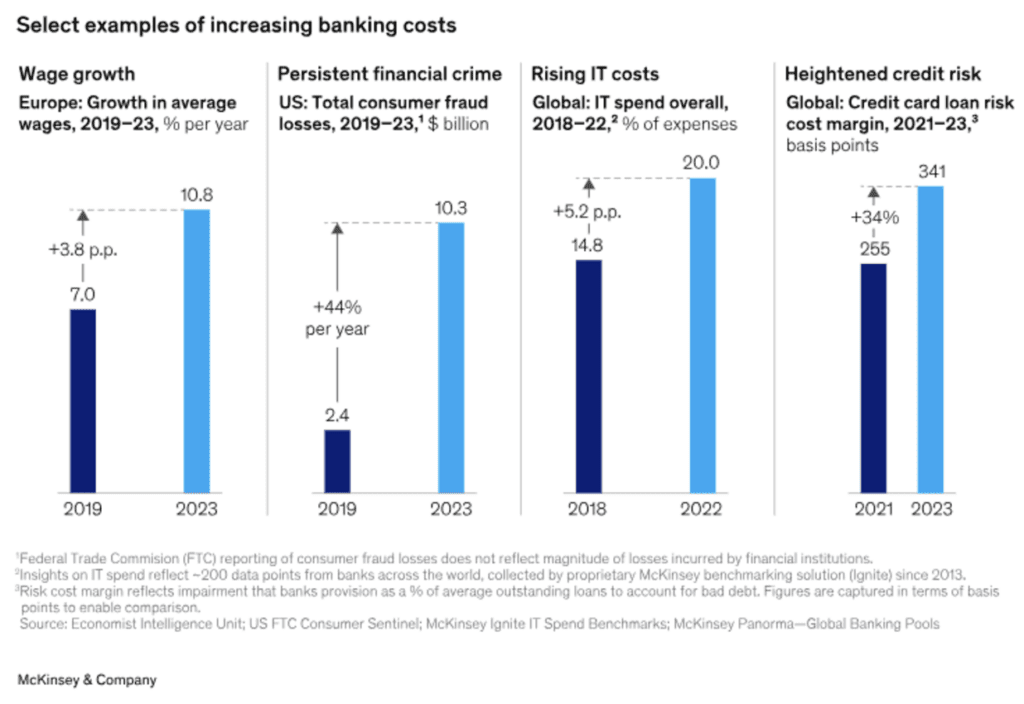

Financial services companies have seen substantial profits in recent years, largely driven by high interest rates. However, market forces are now exerting pressure on asset growth, profit margins, and operational and risk-related costs. According to McKinsey, in 2025, expected declines in interest rates will sharply impact financial institutions, eroding margins and exposing long-standing inefficiencies, increasing cost bases, and low returns on capital.

The future financial services environment will also be marked by increased regulatory demands, heightened customer expectations, and rapid technological disruption, especially from AI. Financial institutions can no longer afford to deliver poor customer experiences or risk privacy and data breaches that damage customer loyalty and erode margins.

To succeed in this future, institutions must adopt adaptable tools and business models that enable them to respond quickly to changing market conditions, innovate for growth, and improve operational efficiency. Decision Intelligence has become a powerful tool for financial institutions seeking to gain a competitive edge. These tools enable faster and more accurate complex decision-making, driving operational efficiency, enhancing risk management, and elevating customer satisfaction.

In this article, we’ll explain what Decision Intelligence is, but with a focus on use cases in financial services.

What is Decision Intelligence, and Why Does it Matter?

A Decision Intelligence platform enables financial services companies to automate complex decision-making through a combination of a business rules engine (BRE), machine learning, and workflow automation, as well as integration with enterprise software. This flexible, low-code environment empowers business users to build, test, and implement decision logic in a way that improves the speed and accuracy of decisions and processes in critical areas such as credit scoring, risk assessment, and loan origination.

Unlike traditional decision-making processes, which rely on manual reviews that are prone to error or cumbersome rules programming and enforcement, Decision Intelligence makes it easy to change business rules and reduces error rates. This capability is essential in financial organizations, where the speed and precision of decision-making directly impact operational performance, customer satisfaction, regulatory compliance, and risk management.

Common Decision Intelligence Use Cases for Financial Services

Decision Intelligence has versatile applications across various domains within financial services. Here are five prominent use cases:

- Credit Risk Assessment: Decision Intelligence augments risk assessments and lending decisions by consolidating customer information and automatically evaluating lending risk to individuals or businesses, analyzing credit scores, transaction histories, and other financial indicators.

- Fraud Detection: Decision Intelligence uses machine learning to identify unusual transaction patterns and predict potentially fraudulent behavior, minimizing financial losses and safeguarding assets.

- Regulatory Compliance: Decision Intelligence automates compliance processes and allows business users to easily adjust policies and rules in response to changing regulations, reducing compliance risks and potential penalties.

- Customer Experience: Automated decisioning improves customer-centric processes, such as speeding up onboarding or credit approvals, and enables personalized service and product offers through customer segmentation.

- Loan Processing: Decision Intelligence streamlines loan processing from application to approval.

Performance Enhancements Decision Intelligence Delivers to Financial Services

Decision Intelligence delivers performance improvements covering multiple facets of financial services operations:

Greater Efficiency and Speed

Decision Intelligence accelerates routine processes and decisions traditionally requiring manual efforts, such as compliance reviews. Processes like loan approvals and credit assessments that once took days can be completed in hours or even seconds. This efficiency gain enhances customer satisfaction and loyalty by delivering faster service.

Enhanced Risk Management

Managing vast amounts of transaction and customer data requires effective risk management in financial institutions. Decision Intelligence helps manage risks by flagging unusual transactions or high-risk customers, allowing institutions to prevent fraud and mitigate financial risks proactively. This capability is particularly valuable in credit and regulatory risk assessments, where accurate evaluations can avoid losses or penalties.

Improved Customer Experiences

Today’s customers expect personalized and responsive services from financial providers. To achieve this, financial institutions must use technology and data insights to anticipate customer needs and deliver relevant products and services. Decision Intelligence enables real-time credit evaluations, tailored offers, and custom recommendations, creating relevant and timely interactions. By understanding individual customer profiles, Decision Intelligence fosters trust and strengthens customer engagement.

Better Organizational Scalability and Flexibility

Decision Intelligence enhances team coordination and organizational adaptability. These platforms are highly scalable, allowing organizations and teams to adapt quickly to changes in regulatory requirements, customer needs, and market dynamics.Transparent decision processes promote organizational flexibility and ensure decision-making is reliably data-driven and consistent.

Cost Reductions

AI-decisioning lowers costs in a variety of ways. Automation reduces labor and error costs associated with document processing, reviews, and decision-making. It also minimizes credit, fraud, and compliance-related risks, avoiding a loss of assets and penalties and protecting margin in the process. Finally, improved customer satisfaction reduces churn and acquisition costs, further safeguarding profitability.

InRule Use Cases Decision Intelligence in Financial Services

Several case studies highlight the positive performance impact of Decision Intelligence in financial services companies.

- MortgageFlex, a company that offers an end-to-end lending solution, LoanQuest.NET, for credit unions, brokerages, and lenders, implemented Decisision Intelligence to streamline its lending platform. The company embedded dynamic decisioning logic to make LoanQuest .NET easily customizable for its customers. Lenders are able to create rules and workflows that are unique to the organization and drive compliance via workflows. This change allowed MortgageFlex to reduce processing times significantly, enhancing customer satisfaction while maintaining high compliance standards.

- Temenos is a company specializing in enterprise software for banks and financial services that powers analytics, channels, core processing, financial crime, lifecycle management, payments, and risk & compliance. The organization’s customers leverage InRule as part of their Temenos solution to author and manage business rules for data validation, to automate loan origination, to enhance cross-selling and upselling, and for many other functions.

- Wesleyan Assurance Society offers insurance and financial services to medical professionals, teachers, and lawyers. Wesleyan wanted to modernize its financial planning system, speed up the sales cycle, and empower business users to quickly and independently change business rules. Wesleyan’s Decision Intelligence platform now runs thousands of business rules and serves more than 300 users on a daily basis. In addition, through CRM integration, Wesleyan reduced its CRM data cleanse time by 96%.

These cases underscore the Decision Intelligence value in overcoming common financial services challenges. Companies adopting Decision Intelligence report measurable improvements in speed, efficiency, flexibility, and growth.

Unlock the Performance Benefits of Decision Intelligence in Financial Services

Decision Intelligence can help financial services organizations protect margins and improve performance by better managing costs and risks while delivering better customer experiences. By automating and improving the accuracy of decision-making processes, companies can increase efficiency and flexibility, gaining the agility needed to adapt to industry changes and remain competitive.

To learn more about how Decision Intelligence can transform your organization, download our ebook, Innovating Financial Services with Decision Intelligence, for more insights, benefits, use cases, and further case studies that highlight the power of Decision Intelligence and its potential.