For more than 50 years, a dental insurance provider has offered benefit services, claims processing, plan administration and services to employers across the state in which it is located. The organization proudly serves more than 1.8 million subscribers and their family members.

Project Overview

The dental insurer provides their external brokers with a quoting tool that, while valuable for providing quotes on the fly, had limitations and did not provide the flexibility that was required to keep up with the company’s speed of business. The rules and calculations for quotes were hard-coded into the application, creating a significant undertaking when it was time to implement annual changes to plans and rates, or to add new products.

The logic that drove the initial quoting tool was originally housed in a 4,000-line PHP file that called 10-15 tables throughout the processing of the code. Any factor changes within a plan required at least a two-week turnaround, requiring IT to sift through the overwhelming code file to make the change and push it live.

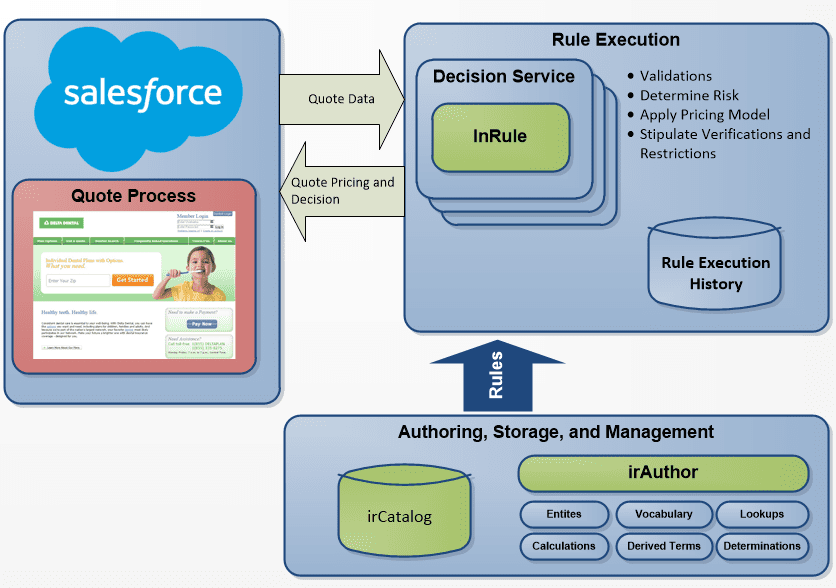

The dental insurance provider was already using Salesforce as their broker management tool, so the organization sought to implement a quoting application within the existing Salesforce implementation. The goal was to empower the Sales team to use Salesforce and to manage their Small Group Products, including plan configuration and design rules, without having to engage IT to make source code changes.

However, the team quickly realized that their rating algorithm was too complex to implement into Salesforce itself, so they began their search for a rule engine that could power the decisioning, while making the most of their existing Salesforce investment.

Solution

After reviewing the capabilities of five open source rule engines and five commercial rule engines, the team decided to move forward with deploying the InRule® business rules management system (BRMS).

According to the organization’s system analyst and project leader for the quoting tool enhancement project, there were several key drivers for the organization’s selection of InRule:

- The easy integration between InRule and Salesforce allowed the company to leverage existing technologies;

- InRule’s testing tool for rule authors, irVerify, helps the organization’s IT team deliver on their commitment to releasing only the highest quality software by providing advanced testing capabilities, including the ability to run regression tests;

- The business language editor within irAuthor, InRule’s authoring tool, provides stakeholders with unmatched transparency into the logic and calculations powering each rule or rule set in an easy-to-read format.

“We have set up some pretty complex calculations in InRule, and being able to show the actuarial team what the math really looks like in a simple, straightforward language gives them confidence that the logic we have implemented is correct and aligns with their expectations,” said the project leader.

Results

As the organization prepares to deploy InRule within their quoting tool, the team has extensively tested and tracked the change in turnaround times for requests commonly received from the business. The chart below shows IT times for changes with the hard-coded approach (IT development and QA) and the times yielded within the InRule project:

| Original Quoting Tool | Enhanced Quoting Tool with InRule | |

|---|---|---|

| Factor Changes | 16-20 hours | 1-2 hours |

| Algorithm Changes | 16-20 hours | 1-2 hours |

| Rating New Plans | 38-45 hours | 1-3 hours |

Next Steps

Upon successful deployment of InRule within the quoting tool, the dental insurance provider will further leverage InRule by empowering the Sales team with the ability to better control their businesses by making changes to plans and rates as the market dictates, and to add new products as they become available – instead of during an annual plan and rate review.

A second phase of the project will be to automate the enrollment process using InRule to drive the rules associated with planning, data verification, communications and more.

Further out on the horizon, the organization plans to use InRule for other business processes, including claims processing.

“Right now, we are focused on modernizing our IT stack by making the most of new technologies,” said the project leader. “InRule is our preferred rules engine and it can easily map into the new technologies that we are building and working to deploy.”

Lessons Learned

When asked what advice he would offer his peers based on the lessons he learned, the project leader stated that it is best to “steer away from hard-coding anything if you can – there’s no long-term value in it. If you can better engage your business stakeholders by using a tool that they can understand and manage, it removes the gap between business and IT and paves the way for your organization to be more collaborative, more cohesive and more successful.”

“We have set up some pretty complex calculations in InRule, and being able to show the actuarial team what the math really looks like in a simple, straightforward language gives them confidence that the logic we have implemented is correct and aligns with their expectations.”